Trusted Advisor or Deal Killer?

Joe Lindsey, M&AMI, CM&AP, CBI

Chairman of The M&A Source

Author’s Note: Let’s start with the thesis that this article was inspired by actual events. It could be an amalgam of multiple experiences combined into one story. Let’s assume that the names, dates, and other data relevant to this article were changed because of concerns of confidentiality. Regardless, let’s see if lessons can be learned from this article.

The business was a provider of chemical products whose primary customers were involved with fracking; the injection of fluid into shale beds at high pressure in order to free up petroleum resources such as oil or natural gas. After more than 20 years of moderately successful operations, the owner (Arnie) and his daughter (Cindy) had reached the point in which they had differing ideas on what to do next with the business. In his mid-sixties, Arnie was burnt out and wanted to explore other opportunities…like retiring and spending more time pursuing leisure activities. Cindy wanted to grow the business, had ideas on how to achieve that growth but was reluctant to assume the personal liabilities and financial guarantees that accompany business ownership.

During a regularly scheduled Chamber of Commerce meeting, Arnie and Cindy were introduced to Dave, a local M&A advisor. Upon hearing Arnie and Cindy’s quandary, Dave said that he would be willing to consider taking them on as a client, but he needed to do some preliminary investigation of their Company. Rather than delve into all of Dave’s customary due diligence, let’s take a quick look at the Company’s financial picture.

| Jan – Dec 2009 | Jan – Dec 2010 | Jan – Dec 2011 | Jan – Dec 2012 | |

| Revenue | 1,461,409 | 2,721,773 | 2,625,789 | 3,854,249 |

| COGS | 263,713 | 485,296 | 447,589 | 645,659 |

| Gross Profit | 1,197,696 | 2,236,477 | 2,178,200 | 3,208,590 |

| Expenses | 842,302 | 1,073,796 | 1,196,215 | 1,137,760 |

| Net Income | 355,394 | 1,162,681 | 981,985 | 2,070,830 |

| Adjustments | 108,655 | 119,336 | 146,799 | 234,829 |

| Adjusted EBITDA | 464,049 | 1,282,017 | 1,128,784 | 2,305,659 |

Based on the financials and other factors, Dave suggested an idea that would provide a mutually beneficial result to both Arnie and Cindy. That idea was a recapitalization with a private equity partner.

A recapitalization would accomplish the following objectives:

- Allow Arnie to retire with a nice pile of cash,

- Provide Cindy with a meaningful equity stake,

- Transfer the business-related personal guarantees and liabilities to a financial partner,

- Institute professional disciplines and financial reporting,

- Provide a team of industry specialists to assist Cindy with her day-to-day operational duties,

- Provide capital to implement and achieve Cindy’s growth strategies, and

- Offer Cindy a second bite of the apple a few years down the road.

Arnie and Cindy were skeptical, but hoped that a recapitalization would be all that Dave promised. Armed with their skepticism, prudence dictated that they get advice from Arnie’s long-time friend he had known since their military days. Whereas Arnie chose the business world as a way to earn his living, his friend Harold went to law school and became rather successful representing the victims of traffic accidents. After all, thought Arnie, a lawyer is a lawyer and who better to trust than an old foxhole buddy? What could go wrong?

With the exception of an attorney with no business transfer experience, and based on what appeared to be a total winning strategy in accordance with the client’s goals and objectives and a valuation from a nationally recognized business appraiser, Dave took the Company to market in early 2013 and began to receive indications of interest. After a series of interviews with prospective partners, Arnie and Cindy agreed on terms and conditions of a Letter of Intent with Chemical Capital Partners (CCP) in March 2013 for $8.75 million. The deal was structured as an 80/20 recapitalization and CCP’s due diligence began soon thereafter.

As the due diligence process began, CCP’s attorney drafted an Asset Purchase Agreement (APA). While reviewing the APA with his client and their attorney, Dave began to remember why it’s a good idea to meet a client’s advisors early in the process.

Because attorney Harold had no business transfer experience but wanted to protect Arnie, he questioned virtually every sentence in the APA and its glossary of terms. The litany of questions allowed Harold time to research contractual agreements between conversations; thereby slowing the process down considerably.

During the next six (6) quarters, Arnie became more and more interested in the value of his business. He instructed Harold to begin having valuation conversations with his CPA. Harold and the CPA soon convinced Arnie that the agreed upon value of $8.75 million was now too low for him to accept. In spite of having read the in-depth business valuation report that Dave had recommended, the CPA offered his own opinion…an opinion in which he stated that the previously obtained report was flawed. In simple terms, the CPA explained that the proper way to value a business was to take a three-year average of its adjusted EBITDA and multiply that number by ten (10). In Arnie’s case, the “proper” valuation would be calculated as follows:

| Period | Adjusted EBITDA |

| Jan – Dec 2010 | 1,282,017 |

| Jan – Dec 2011 | 1,128,784 |

| Jan – Dec 2012 | 2,305,659 |

| Subtotal | 4,716,460 |

| Divisor | 3 |

| Subtotal | 1,572,153 |

| Multiplier | 10 |

| Value | 15,721,533 |

Harold and the CPA pondered why Dave had originally convinced Arnie that the value was $8.75 million instead of $15.7 million, and questioned whether or not Dave had conspired with CCP to obtain a bargain basement price. While that debate began gaining traction, the business negotiations dragged on and the business began to suffer.

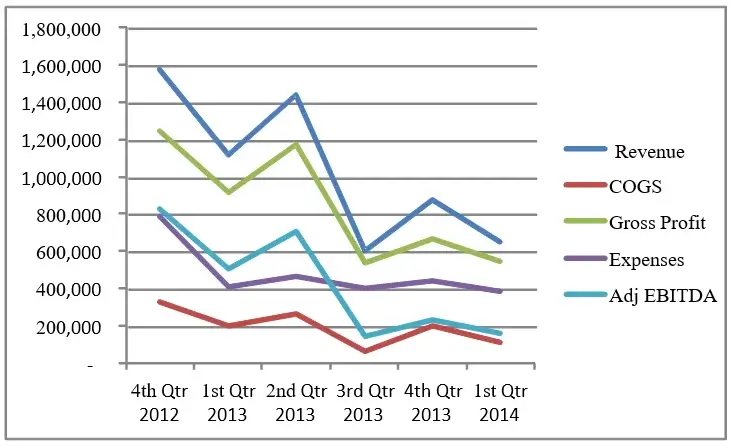

During those six quarters, Arnie began acting as if the business had already been sold and turned all operations aver to Cindy. As it turned out, Cindy was not adequately prepared to run the business without her dad’s assistance. The result was a loss of customers, a steep decline in revenue and bottom line performance, and CCP’s inability to obtain favorable financing for a failing business. Beyond the financing issue, CCP also lost interest in the deal and in Cindy’s ability to lead the Company back to profitability. As such, CCP withdrew their LOI. Subsequently, Dave terminated his sell-side representation agreement with Arnie.

During those six quarters, Arnie began acting as if the business had already been sold and turned all operations aver to Cindy. As it turned out, Cindy was not adequately prepared to run the business without her dad’s assistance. The result was a loss of customers, a steep decline in revenue and bottom line performance, and CCP’s inability to obtain favorable financing for a failing business. Beyond the financing issue, CCP also lost interest in the deal and in Cindy’s ability to lead the Company back to profitability. As such, CCP withdrew their LOI. Subsequently, Dave terminated his sell-side representation agreement with Arnie.

So what lessons can we learn from this less than satisfying experience?

Issue #1: Meet the advisors. Dave dropped the ball on this one. He did not insist on meeting Arnie’s advisors before accepting the engagement. After learning about the attorney’s lack of experience and the CPA’s valuation “expertise,” there was nothing Dave could do to bring in a transaction attorney and a transaction CPA. The deal was all but doomed from day one.

Issue #2: Periodic reviews. Although Dave prepared a trailing twelve month Excel spreadsheet each month, he did not ask questions about the Company’s financial decline or Cindy’s management skills. In hindsight, Dave realized that he stopped his due diligence as soon as his engagement agreement was executed and the offering memorandum was prepared. He more or less depended on CCP to satisfy themselves during their due diligence.

Issue #3: Time is of the essence. Anyone who has been in the M&A profession for any length of time soon realizes the old adage that time is a deal killer. The fact that this one dragged on for an extended period of time and ultimately failed serves as a testament to the need for assembling a team of seasoned professionals, as well as constantly reminding the client that he/she must continue to operate the business like he/she will own it forever because there is no guarantee of a completed deal no matter how optimistic the M&A advisor is in his/her deal-making ability.

Final thoughts & who bears the blame: The finger of blame cannot be pointed at only one person. Let’s consider the cast of characters.

Dave: Dave has to shoulder some of the responsibility for this deal’s failure, specifically for the reasons outlined in Issue #2: Periodic reviews above. Whether intentional or not, or due to a lack of training, Dave’s actions could lead one to the conclusion that he had checked out of the deal. Additionally, Dave neglected to reinforce to Arnie the axiom that he/Arnie should continue to run the Company as if he would own it forever. That’s unacceptable, because as Arnie and Dave now know, there are no guarantees of a successful closing.

Harold and the CPA: Attorneys and CPA’s are routinely considered to be the most trusted advisors that a business owner can have. Because of that belief, and considering the bond that he had with Arnie, an argument could be made that his efforts were made with the best of intentions to protect his old foxhole buddy. That was chief among his reasons for bringing in the CPA. The CPA brought a depth of experience that Harold did not have, but desperately felt was needed. Sometimes, even with the best of intentions, deals fail to close.

Cindy: As it was soon discovered, Cindy was not adequately equipped with the managerial skills needed to inherit the reigns from her father…at least not at this stage of her development. She wanted to live up to her father’s expectations. That’s a forgivable human condition. Did she know that she was jumping into the deep end of the pool? If so, did she have blinders on regarding her abilities or was she overly, but unjustifiably, confident? Given time, perhaps she could have grown into the managerial role. Regrettably for the deal, time was not on her side.

Arnie: If Arnie would be honest with himself, he would realize that he has to shoulder much of the blame for the failure of this transaction. Although it is easy to place blame on him for choosing Harold to represent him, it is sometimes extremely difficult to accept the shortcomings of friends. With the largest financial transaction of his life on the line, Arnie placed his bet on Harold even though Harold had no business transaction training or experience. As it turned out, this friendship proved to be very costly to Arnie.

Arnie part 2: For whatever reason, Arnie checked out of the deal and began pursuing his leisure-type activities. Perhaps this could have been reasonably acceptable if Cindy had been capable of assuming his responsibilities. Was Arnie blinded by the love he has for his daughter or was he sadly mistaken about her abilities? Regardless of his reasons, Arnie must bear the lion’s share of the blame. Ultimately it was his Company, his and his daughter’s financial futures, and his decision to kill the deal. Whether or not he deliberately killed the deal is subject to debate, and maybe fodder for a psychological case study.

Perhaps this article, whether it is fact or fiction, will help you learn from Dave’s experience. That’s got to be better than learning the hard way…and at your expense.